India’s Animation & VFX Industries Doubled In Size In 4 Years Before Covid — Report

A new report from consultancy firm KPMG paints a mixed picture of the state of animation and vfx in India.

The report, “A Year Off-Script: Time for Resilience,” provides an overview of India’s media and entertainment sector against the backdrop of economic strife — initially due to trade barriers and geopolitical tensions, then dramatically escalated by the coronavirus. Segments of the sector are analyzed in separate chapters, one of which is devoted to the animation, vfx, and post-production industries.

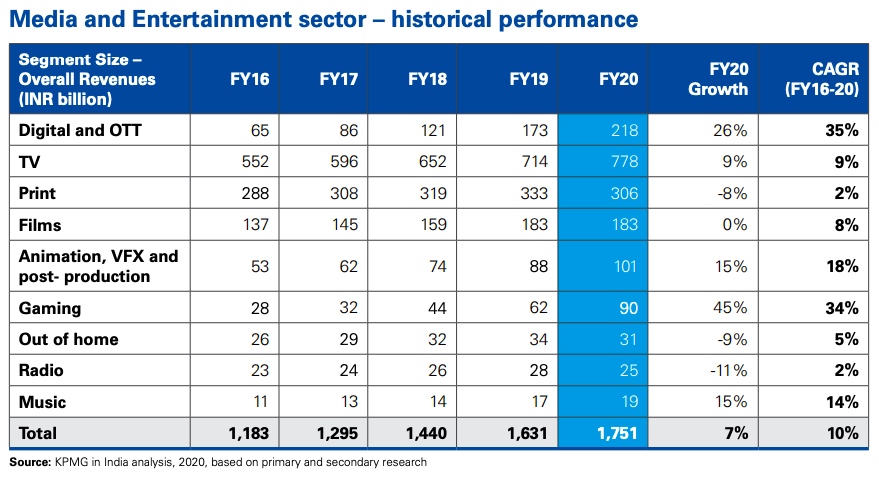

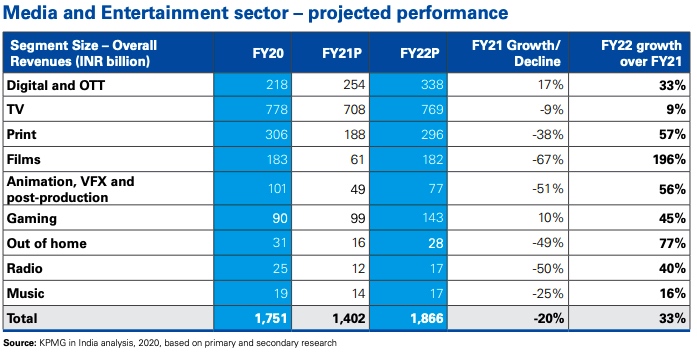

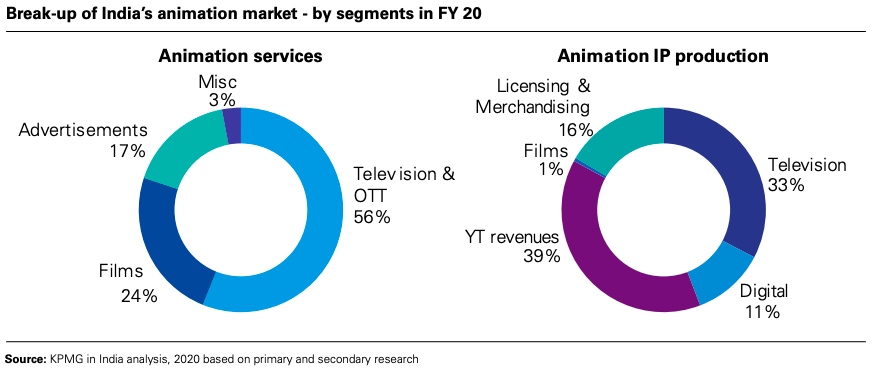

The report illustrates the underlying health of the industries, which almost doubled in size in the four years before the pandemic. It grew from 53 billion rupees (USD$719 million) in fiscal year 2016 to 101 billion rupees ($1.37 billion) in FY2020. Of that, animation accounted for 21.8 billion rupees, vfx and post-production for 79.5 billion rupees.

Various reasons are provided for this growth, some universal, some specific to India. The report cites growing demand from over-the-top (i.e. streaming) services, noting the success story that is Mighty Little Bheem, Netflix’s first animated series from India. There is also a growing market for animated spin-offs from Bollywood franchises, such as the upcoming Dabangg (image at top) from Cosmos-Maya and Arbaaz Khan Productions.

As for vfx, there is rising demand from both Bollywood and international producers. The report also observes that, in both animation and vfx, overseas clients are starting to shift their outsourcing away from China due to “prevailing anti-China sentiment.” This could benefit Indian service studios.

Growth, of course, has come to a juddering halt this year. Turning to the fallout from the pandemic, the report projects that the animation and vfx industries will more than halve in size in FY2021, plummeting to 49 billion rupees — a sharper fall than in any other segment bar films (see table above). Much of that contraction comes in vfx and post-production, dependent as they are on the disrupted live-action industry.

Among the problems experienced across animation and vfx since the lockdown are security issues concerning clients’ IP, and low internet speeds and bandwidth in homes. Small studios were slower than large ones in transitioning to remote working, in some cases taking one and a half months to return to full service. The report warns that many of these studios are likely to go out of business.

It also mentions roadblocks outside the pandemic — notably the introduction of COPPA, a regulation that has decimated the Youtube ad revenue of kids’ content producers. This has slowed the growth of IP creation.

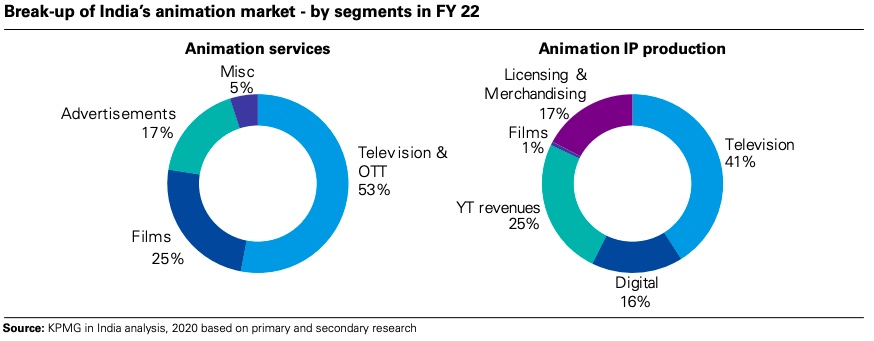

On the other hand, the report identifies opportunities in the pandemic. The rebound in vfx is likely to be spurred by increased demand for previs as producers seek to minimize time spent on sets. Animation studios may well devote more resources toward creating their own IP, in order to diversify their revenue and become more self-sustaining.

Ultimately, the animation, vfx, and post-production industries are projected to climb back to 77 billion rupees in FY2022.

“A Year Off-Script” contains valuable in-depth research, not least in a number of case studies and themed chapters exploring subjects like gaming and education tech — two areas driving the demand for animation in India (and elsewhere). Read the full report here.

.png)