Streamers, Networks, Theaters Aren’t Meeting Audience Demand For Animation, According To New Data

Parrot Analytics, an industry leader in global audience demand measurement, held a web-based seminar last week showcasing the power of animation to attract large and diverse audiences from around the world.

The webinar was led by Parrot analyst Adriana Pascale, who argued that in the current content climate, demand for animation outweighs the supply more than almost any other category tracked by the company.

Here’s a rundown of Parrot’s findings, which they’ve shared with Cartoon Brew:

Audiences want more animation than companies are offering

In her presentation, Pascale divided all tracked tv productions into categories: animation, action and adventure, kids, comedy, factual, and sports. Using the demand data for those productions, she concluded that since Q1 2020, just as Covid-19 began to spread, animation saw a greater increase in demand than any other category. In fact, audience demand for animation has nearly doubled over the past two-and-a-half years.

The supply, on the other hand, hasn’t kept pace. Comedy, reality, and documentary programming are all produced in greater quantities than animation, despite having lower demand scores among audiences. Streamers, networks, and exhibitors should take note, Pascale argues, and up the amount of animation they provide to their customers.

Parrot collects data from several sources to determine audience demand for film and tv content and to give a “demand score” to each title. According to the company, “Demand is a holistic audience measurement system that tracks and captures the 21st Century consumer’s interaction with content. Parrot Analytics combines P2P consumption data with research, social media, and social video activity to determine the cross platform demand for content and talent, determining which series or actors are most likely to drive subscription growth.”

Streaming Supply

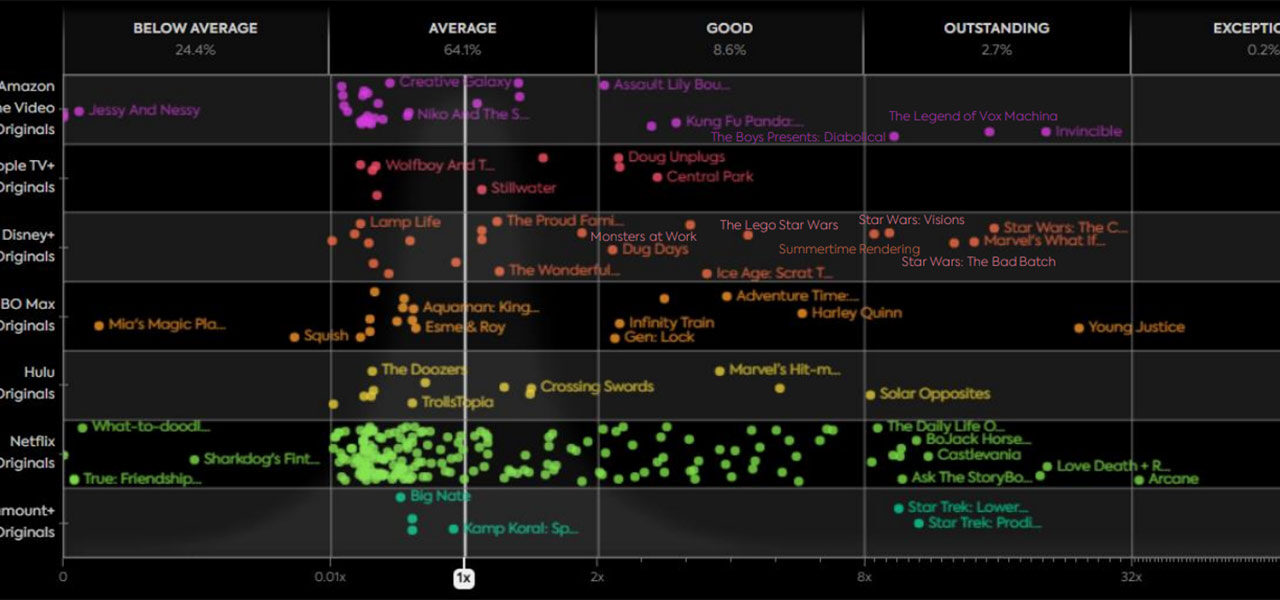

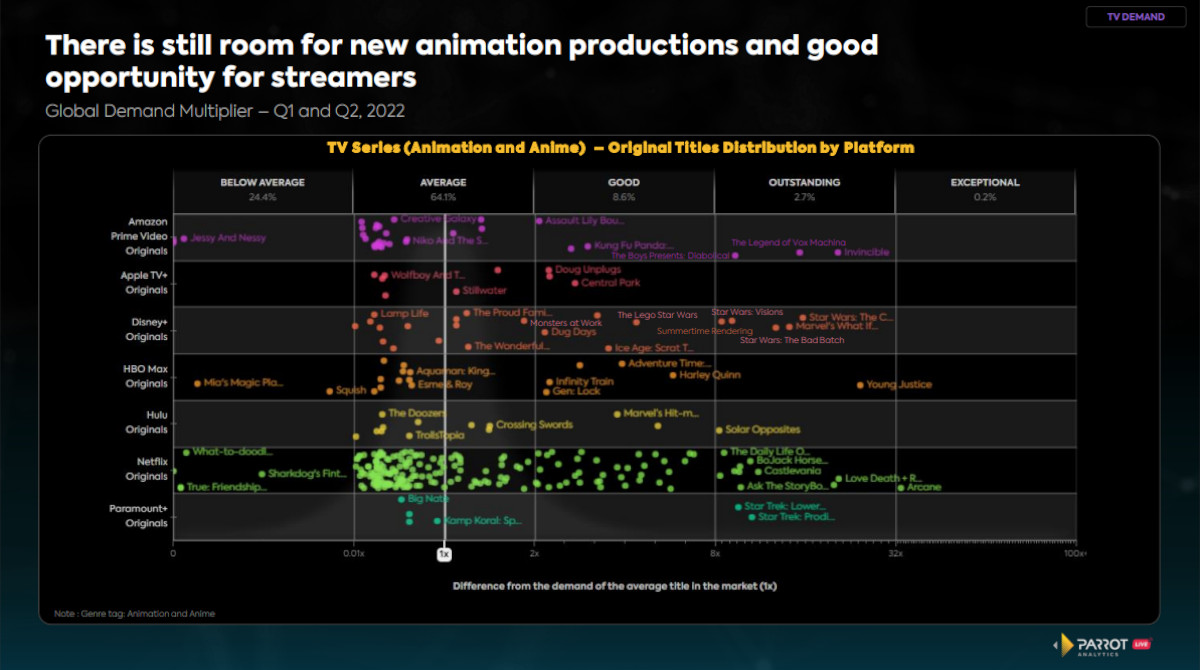

Using its data, Parrot can provide a big picture look at where audiences are being best served, and where platforms could stand to improve. Based on audience demand in the first half of 2022, Netflix is strong on anime, Prime on pre-school content, Disney+ has the most in-demand originals, and HBO Max has the most desirable adult animation catalog.

Netflix and Disney+ are currently the two streamers with the most animated content overall, and the most in-demand content.

Demand

Parrot divides animated content into more genres and categories than we would want to list here. The data provides some interesting narratives, though. For instance, Japanese animation is, by a fairly significant margin, the category of animation with the highest demand. By genre, the most in-demand animated content includes superhero shows, animated sitcoms, and action fantasies.

Despite hitting Netflix last year, Riot Games’ Arcane was still the most in-demand series over the first two quarters of 2022, and was among the top 0.2% of all TV shows in terms of demand score. Other animated series which boasted exceptional demand scores this year were Disney+’s What If…?, HBO Max’s Young Justice, Prime Video’s Invincible, and Paramount+’s two Star Trek animated series, Lower Decks and Prodigy, among many others.

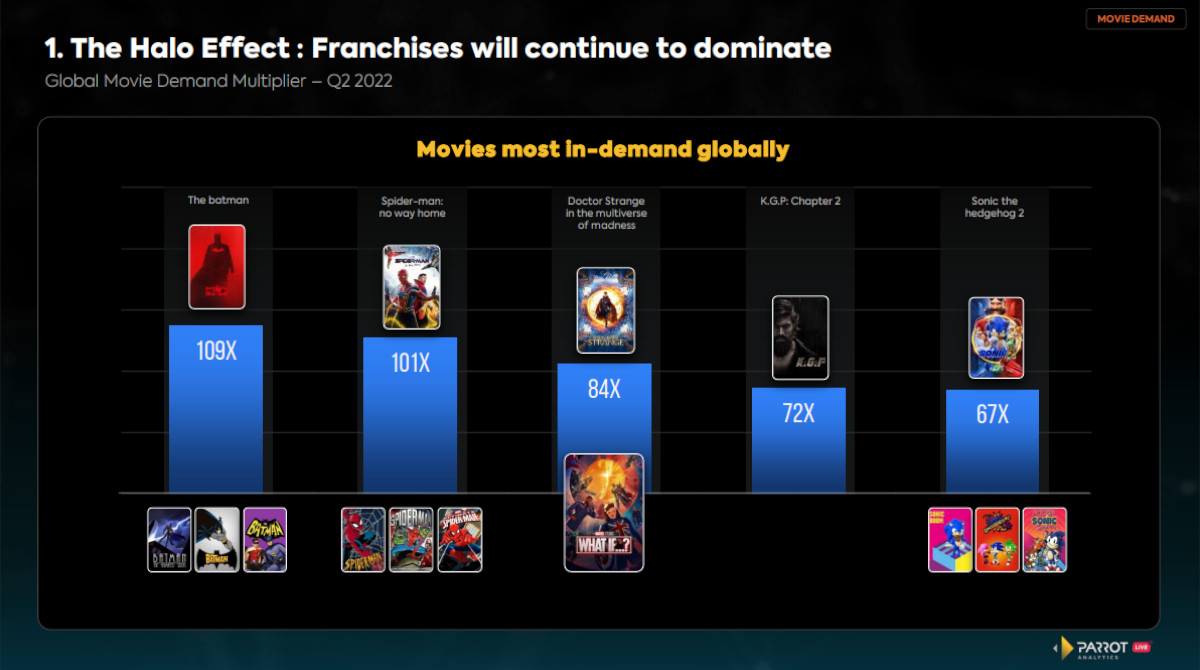

Animation’s Halo Effect

Another major talking point on the day was what Parrot describes as animation’s “halo effect” on non-animated content available on streaming services. Using demand score data collected over time, the study outlined the peaks and troughs for franchises which have both live-action and animated content.

Specifically, the presentation showed how demand for animated content peaks when corresponding live-action content is released, and vice versa. With the Q2 release of The Boys season 3 on Prime Video, Diabolical saw a huge bump in engagement and landed in the top 2.7% of all TV shows for demand. Animated Batman content saw a similar spike when Warner Bros.’ The Batman hit theaters, and when Spider-Man No Way Home and Doctor Strange in the Multiverse of Madness came out, Disney+’s What If? series went viral all over again. Similarly, when new animated series are released for popular IPs, demand scores for older live-action entries from those franchises almost always see a significant bump in demand.

Animation Travels

Near the end of her presentation, Pascale took a moment to highlight animation’s exceptional capability to go global, using the popular Russian kids’ series Masha and the Bear as an example. Parrot uses its demand scores to give every show a “travelability” rating. The rating represents the demand for a title in a given market compared to that same title’s demand in its country of origin. A travelability score over 60% is exceptional, and Masha surpassed that mark in the U.S., Ukraine, Brazil, and Italy, scoring high marks in dozens of other countries as well.

.png)