Mattel Announces Acquisition of HIT Entertainment, Owners of Thomas & Friends, Barney & More

Mattel, Inc. (NASDAQ:MAT) announced today that it has entered into an agreement to acquire HIT Entertainment for $680 million in cash from a consortium led by Apax Partners funds. HIT Entertainment owns a global portfolio of popular preschool brands, including Thomas & Friends®, Barney®, Bob the Builder®, Fireman Sam® and Angelina Ballerina®. With more than $180 million of revenues, HIT Entertainment represents one of the largest independent owners of preschool intellectual property. The purchase price equates to a multiple of about 9 ½ times trailing earnings before interest, tax, depreciation and amortization.

“Mattel is the right home for Thomas & Friends®. This powerhouse brand is joining the ranks of such iconic brands as Barbie®, Hot Wheels®, Fisher-Price® and American Girl®,” said Robert A. Eckert, chairman and chief executive officer of Mattel. “Thomas & Friends® routinely ranks among the world’s leading preschool toys. Additionally, with more than half of the Thomas & Friends® revenue generated from non-toy products, this transaction will marry Mattel’s global marketing, distribution and brand management capabilities with HIT Entertainment’s global programming and licensing expertise to accelerate growth of the combined portfolio.”

“HIT Entertainment owns some of the most loved and trusted preschool brands in the world and under Mattel’s leadership, I look forward to seeing them grow to even greater heights,” said Jeffrey D. Dunn, president and chief executive officer of HIT Entertainment. “Mattel is a wonderful steward of brands and a great home for the outstanding properties HIT has developed and grown, including Thomas & Friends®. It is fitting that the world’s premier toy company should become the owner of the world’s premier pre-school property.”

Irina Hemmers, a partner in the Apax Media team, commented: “We are very pleased that this strong portfolio of iconic brands will continue to flourish in the hands of Mattel. Â Fisher-Price already produces HIT’s toys under license so the two companies know each other well and there is considerable industrial logic in this combination. I would like to thank the employees and the management team for ensuring that HIT’s brands achieved their leading global position in the preschool character space. We wish the whole company every success for the future.”

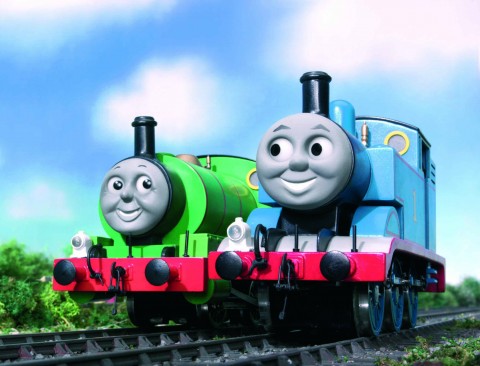

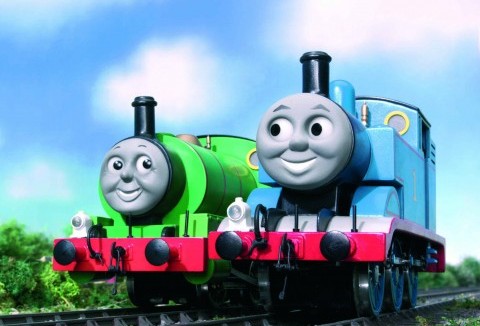

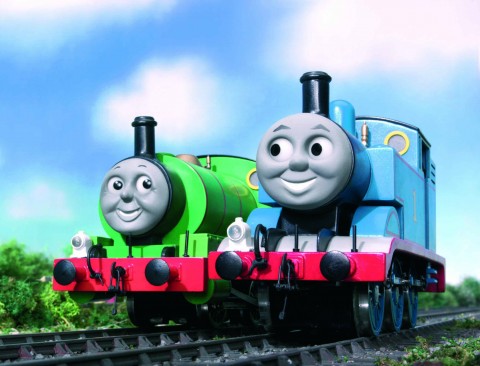

Thomas & Friends® is the premier brand in the HIT Entertainment portfolio. Created more than 65 years ago, the brand has grown into the #1 licensed preschool property in the world, with television programming, home entertainment products, toys and other consumer products available throughout the globe.

Mattel currently markets many Thomas & Friends® toy products under a license from HIT Entertainment which extends through 2014.  Mattel’s global sales of Thomas & Friends® die-cast and plastic toys are more than $150 million, and Mattel believes that this transaction will allow the company to continue to expand and grow these product lines into the foreseeable future. Another key advantage to the acquisition is that Mattel will be able to reunite two key pieces of the Thomas & Friends® toy business: plastic and die-cast toys with the wood-based business. The current wood license expires at the end of 2012, at which time Mattel expects to add that line of business to its portfolio. Historically, the sales of wood-based toys have been around half the size of the plastic and die-cast business.

The HIT Entertainment portfolio also includes a number of other highly popular preschool brands with established television broadcast and licensing relationships around the world. The acquisition does not include HIT Entertainment’s interest in the cable network station, Sprout.

Eckert went on to say, “We work in a creative business and understand the value of strong and talented leaders, teams, and people. HIT Entertainment has a great talent base with strong competencies in content production, management and licensing. The addition of the HIT Entertainment team will complement our licensing business and also augment our capabilities on the content side.”

The transaction is expected to be financed with a combination of cash and debt and is expected to close in the first quarter of 2012. The transaction is not expected to have a material impact on Mattel’s 2012 earnings, but is expected to be increasingly accretive as the benefits of owning these brands are reflected in Mattel’s results, including the addition of Thomas & Friends® wood business in 2013 and retention of Thomas & Friends® plastic and die-cast business from 2015 onwards.

The transaction is subject to clearance under the Hart-Scott-Rodino Antitrust Improvements Act and other customary closing conditions. RBC Capital Markets, LLC acted as financial advisor and Latham & Watkins LLP served as legal advisor to Mattel in connection with the transaction. BofA Merrill Lynch acted as financial advisor and Weil, Gotshal & Manges LLP served as legal advisor to HIT Entertainment in connection with the transaction.